The implementation calendar is the same as for the B2B e-invoicing obligation. French authorities confirmed that it will be mandatory to report data of these transactions. However, exports, imports, sales to private individuals (B2C), intra-Community supplies, or acquisitions would not fall within this category. To create a more precise and more complex picture of economic activity to enable the organization and improvement of economic policy for businesses.Į-reporting is the obligation to declare to French tax authorities sales not falling within the scope of French e-invoicing.įrench e-invoices will be required for all sales between French businesses.Speed up the fraud detection process, thus making the VAT reporting process more transparent.Simplifying, in the long term, VAT reporting obligations for businesses by pre-filling returns.Reducing the cost to businesses of paper invoices.Increasing competitiveness between businesses by accelerating digital transitions.This platform can be the same as your provider, a different platform, or the public portal because these platforms must be compatible for the exchange.

Invoices received from your suppliers will be sent to you electronically through the selected platform.

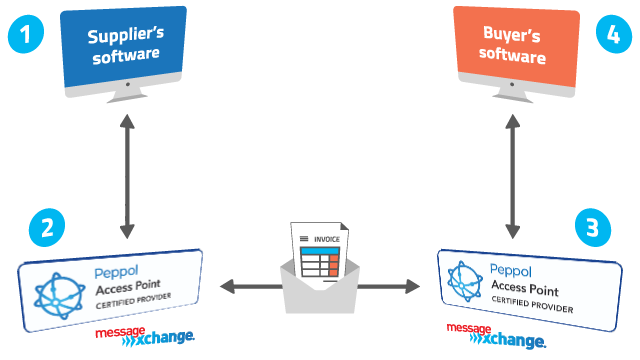

In their role as an intermediary between the supplier and client, these platforms will have the ability to transform the form of the invoice issued by the supplier into a format suitable for the client.

#E INVOICING PRO#

Currently, e-invoicing in France concerning transactions with the public administration (B2G) via the Chorus Pro platform. How will you issue and receive e-invoices?Įlectronic invoices will be sent to the business client via a dematerialization platform, whether the public portal or another private electronic platform. It is important to note that, despite the progressive implementation calendar, all companies must be able to receive electronic invoices by 1 July 2024.Į-invoicing will apply to B2B taxable transactions made between companies established in France and when French invoicing requirements apply. 1 January 2026: small and medium-sized companies with less than 250 employees and an annual turnover of less than EUR 50,000,000.

0 kommentar(er)

0 kommentar(er)